eeuu, findes and feargle I asked Google “Is chile an good investment?” and got this answer " Chile is highly regarded as one of the strongest investment destinations in Latin America and the country has made progress in facilitating starting business procedures over the last few years by enabling online registration of closed corporations."

Rumor has it that Musk and his bro bought a vineyard for 20 mil US in 2020. His bro is in the restaurant business, both visited in 2017, Musk has been back and forth multiple times, including and since 2020. And Musk does not like Boric so adios to that lefty.

I personally think the southern hemisphere is going to become more attractive as the Northern Hemisphere goes through a long, overdue economic and societal collapse.

Also try asking Chat GPT for 10 reasons to invest in Chie.. no wait, I already did. Here is the answer:

Here are 10 compelling reasons to invest in Chile:

- Stable and Transparent Economy

Chile boasts one of Latin America’s most stable and open economies, with strong institutions, low corruption, and a solid legal framework. It’s ranked high in the region for ease of doing business.

- Strong Trade Agreements

Chile has over 30 trade agreements covering more than 60 countries, including the U.S., EU, China, and Japan, giving investors access to 86% of the global GDP with preferential terms.

- Strategic Location

Positioned as a gateway to Asia-Pacific markets, Chile is ideal for companies looking to operate across both South America and Asia, with modern ports and logistics infrastructure.

- Abundant Natural Resources

Chile is the world’s largest copper producer and also rich in lithium, silver, and other key minerals, making it a hub for mining and clean energy investment.

- Renewable Energy Leadership

With vast potential in solar, wind, and hydro energy, Chile is leading the region’s energy transition. Its Atacama Desert has the highest solar radiation on Earth.

- Growing Tech and Innovation Hub

Chile’s Startup Chile program is globally recognized for supporting entrepreneurs. Santiago is becoming a major Latin American tech and innovation hub.

- Sound Fiscal Policy

The country maintains prudent fiscal management and inflation control, supported by an independent Central Bank and long-term sovereign wealth funds.

- Skilled Workforce

Chile has a well-educated and highly skilled workforce, with a strong focus on STEM fields, bilingual education, and digital literacy.

- Investor-Friendly Regulations

Foreign investors are treated on equal footing with locals, with strong protections for property rights and a clear, streamlined process for setting up businesses.

- Sustainability and ESG Focus

Chile is pushing ahead on Environmental, Social, and Governance (ESG) fronts, becoming a top destination for green investment, including green hydrogen and sustainable agriculture.

And then I asked for 10 reasons to NOT invest in Chile:

Sure — here are 10 reasons someone might be cautious or choose not to invest in Chile, depending on their risk tolerance and investment goals:

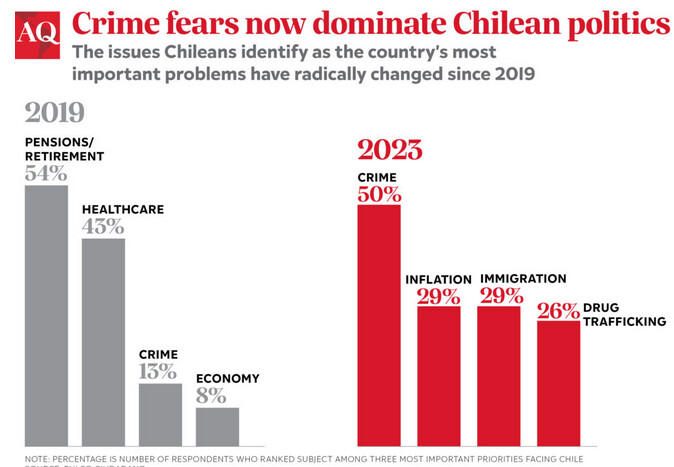

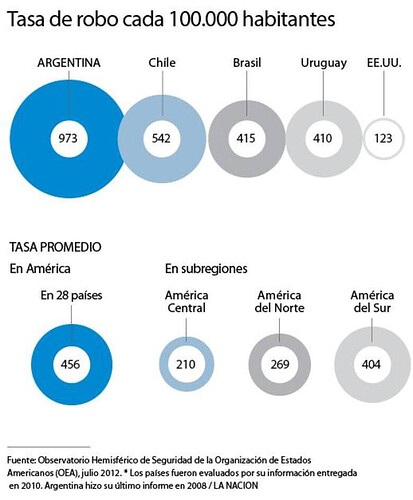

- Political Instability

Recent years have seen significant social unrest and political uncertainty, including debates around constitutional reform, which can create unpredictability for investors.

- Regulatory and Legal Changes

Potential reforms in mining laws, labor regulations, and tax policy could affect profitability, especially in sectors like natural resources.

- Dependence on Commodities

Chile’s economy is heavily reliant on copper exports. A downturn in global copper prices can significantly impact the country’s economic performance.

- Currency Volatility

The Chilean peso has experienced periods of instability, which can erode returns for foreign investors.

- Environmental Risks

Chile is prone to natural disasters like earthquakes and droughts, which can disrupt infrastructure and supply chains.

- Limited Market Size

With a relatively small population (around 19 million), Chile offers a limited consumer base compared to larger emerging markets.

- High Corporate Concentration

Certain industries are dominated by a few large players, which can stifle competition and innovation.

- Social Inequality

High levels of income inequality can fuel unrest and hinder long-term economic development.

- Pension Reform Uncertainty

Ongoing debates around the future of the pension system could have implications for domestic investment flows and financial sector stability.

- Regional Risks

While Chile is considered relatively stable compared to some of its neighbors, regional instability in Latin America can still have spillover effects.

As far as I know chat GPT has no alliances but does have a voracious hunger to collect and analyze data.