So this week’s news is full of “Trump tariffs.” And we are here in Chile Vivo, Mierda.

I just happened to bump into one of the local Aduanas lads. I hope I remembered this stuff correctly because it’s going to be on the final.

The new “Trump tariff” on products from Chile for the US is reported to be 10% for most things.

Ten percent. Remember that. It will be on the test.

In a lead-up to today’s news, the USD has gotten stronger here and the CLP is diving a bit. Nothing critical. Yet.

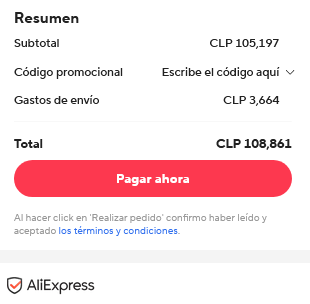

Now let’s look at what Chile charges for imported products – most products – from the US. There is a free trade agreement that exists that might continue to have some products exempted, depending on ongoing negotiations.

For products not exempted, the effective tariff on US stuff is about 26 percent in most of the country. As we all learned this week, 2.6 x 10^1 is considerably greater than 10 .

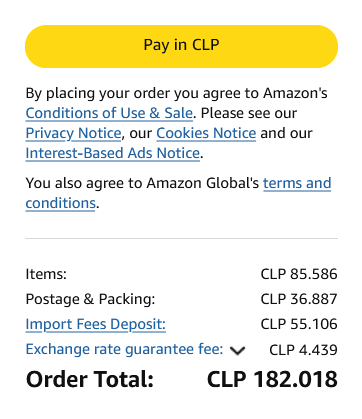

How do we get to 26 percent? I’m glad you asked.

Aduanas first charges for CIF: Cost, Insurance, Freight. That’s 6 percent. So if a product lot is invoiced at US$5000, the associated transit insurance is US$100, and freight is calculated at another US$100, then the basis for CIF is US$5200 and 6 percent of that is, umm, about US$322. I looked it up and they call that Arancel Ad Valorem

IVA here is considered, among other things, an import tariff and also a “tax upon a tax.” Very Chileno but not uniquely so. And its basis is calculated as Arancel Ad Valorem plus the original invoice value, which was US$5000, but when Arancel Ad Valorem is added we have US$5000+US$322 and IVA is calculated as 19% of that sum: 5322 x .19 => about US$1011. Net cost of aranceles: 1011 plus 322 => 1333 or 26.6 percent of the invoice cost for the lot of product.

Fun facts: For those of us, both of us, in the Extreme Regions (and I take some degree of pride in being Magallanico Extreme) the Arancel Ad Valorem is 1.5% on CIF, and no IVA. but that is only when you are an authorized importer within the extraterritorial Zona Franca. Fun fact number two: when I import vehicles into the country, that have been driven to this region, into the Zona Franca, there are no legitimate freight and insurance costs for calculating CIF. So Aduanas requires that my usuario de ZF agent create invented numbers for those by subtracting small amounts from the “invoice” figure.

If that Trump government were playing with a full deck, they’d have a tariff on Chilean imports closer to that 26 percent. I won’t say anything if you don’t.