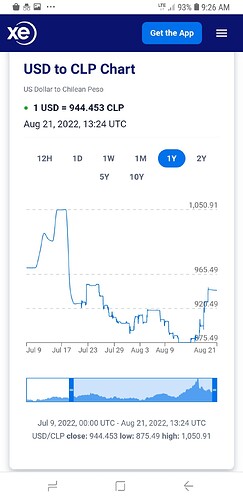

xe.com definitely wrong as Santander currently buys dollars for 930 according to my online bank. I will always take that as the real rate, because if they screw up, it will be very expensive for them…

but several days with XE being so off is strange

xe.com and https://www.x-rates.com have caught up to reality finally, just took longer than I thought

maybe save this link if you check regularly

https://www.bloomberg.com/quote/CLP:CUR#xj4y7vzkg

everyone has it at 944-946 range at end of day

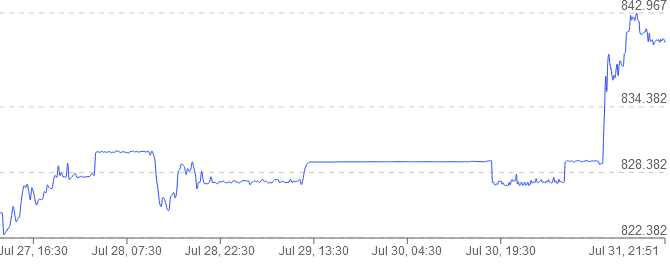

apparently today’s move is due to copper price rise due to Chinese regulators on Sunday urging banks to extend real estate loans

I assume the logic here is loans for building = more building = more copper demand

(I am not familiar with mining.com but you can find the same news on a bunch of other sites)

While central banks are all a bad idea, if you’re gonna have one, make it private like the Fed (but don’t be the Fed). The only reason South Africa is still standing is because the ANC commies can’t get their grubby little paws on the Reserve Bank, although are trying to change the constitution to change that.

Blew half the USD reserve on intervention in mid july for the peso, but its already nearly “recovered” half way to the all time high and August isnt even over yet. Was it worth it for this flash in the pan? What about our dignity? I cant figure out if a weaker peso or the fact that we have 25 billion less USD…which is worse for our collective dignity?

Mosciatti makes the same point here (07:59), and thinks, as I do, that propping up the Peso was a decision taken for political, not monetary reasons.

The government doesn’t care what happens after 04/09.

Yeah, who would have ever thought USD reserves of Chile would be less than Peru’s.

That Marcel dude could have retired in semi-anonymity but instead joined up with commies to probably be forever condemned in the history and economic textbooks.

OK this needs watching.

Going back to my theory that the Empire really does not care if Chile goes commie or not and is more than happy to see Chile’s conversion to just another broke Ibero-American country (see an above post, around 10 above this post).

Hacienda and the Central Bank just signed up for a US $18,500,000,000 IMF line of credit that can be used any way the Chilean authorities want.

A previous much smaller line approved during COVID and Piñera which was never used was retired.

Can the commie$ keep their hand$ off of thi$? Argie, here we come!!

No way can they keep the hands off. It is going to be spent on improving perceptions of dignity as soon as possible

Look what Rechazo did for the peso…and the chilean stock market

The peso has only gained about 1% in value as a result of Rechazo

Maybe the traders didn’t think Apruebo would be that bad after all

Although it could be because the existing dollar price had already factored in an 80%-90% chance of Rechazo

I think that it has more to do with the fact that Rechazo means bugger-all in terms of future certainty.

After all the shit that has gone down, I was deeply afraid to research if they had used this credit line but according to this:

the answer seems to be NO thus far.

But worth watching closely as no one inside the country left or right with a scrap of dignity wants to help fund their games any longer.

On the matter of “very weak peso” – here is the track from the past few months. In recent days we see stronger dollar vs CLP but it will be interesting to see how far it goes towards that 900:USD mark. There is money to be made in this sort of trading.

In related news, we have been buying mightily in Argentina with the “Tourist Dollar” rate which can be had by using dollar denominated credit or debit cards. Within a couple of days the AR central bank gives you a refund of about 40 percent vs the official ARS purchase price. That is effectively the “Blue Dollar” rate without having to carry piles of cash. This means that AR domestically produced items such as packaged food (pasta, etc), hardware, kitchenware, fuel, whatever and especially “precios cuidados” – price controlled stuff – is heavily discounted.

Wow…if the peso was stronger maybe this guy could have a real hood instead of a roof panel.

At least homey could afford the premium roof panel versus wavy cheaper one. Would not have fit so well but perhaps more airflow to that engine like a turbo charger.

So chile!

That brought me back a memory of our previous neighbor. We nicknamed him sierraman because he constantly ran his electric saw. He had a just got out of prison look to him. Anyways, either sierraman or bride of sierraman got into a fender bender and their car trunk wouldn’t close. So, they took the trunk door off and drove around like that for 3-4 months!

The SQM Stock has been trending up, and now with the news that Chile’s Codelco to control new lithium venture with miner SQM. It seems that things, hopefully, stabilize.